Flexina Invoicing

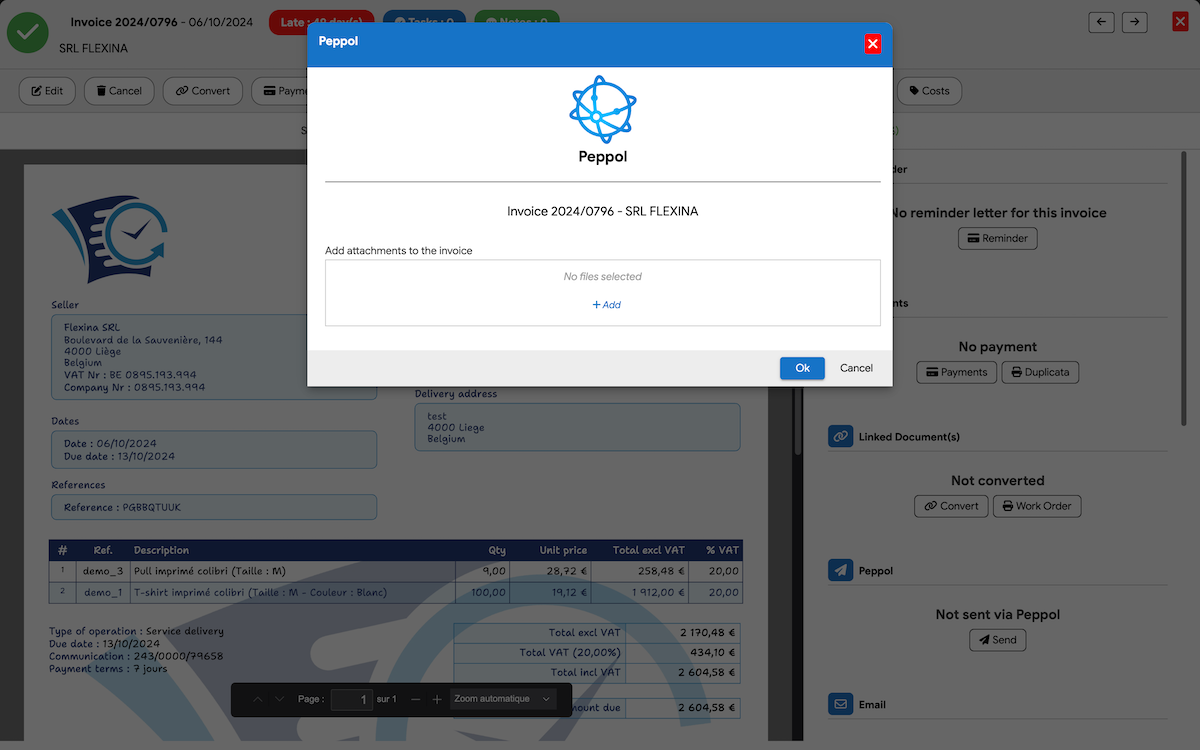

Optimize your electronic invoicing operations with our online software. Sending your e-invoices via the Peppol network becomes quick and easy with Flexina.

Simply complete the Peppol network registration form, and in less than 5 minutes, you're ready to send your e-invoices. Say goodbye to the complexity of UBL conversion, tedious Peppol file validations, cumbersome attachment adding, endless verification of your recipient's presence on the Peppol network, or even re-encoding your invoice information...

Flexina simplifies every step: in less than 5 minutes, you'll be ready to send your electronic invoices to administrations or for public procurement in Belgium. Moreover, rest assured that Flexina will be ready for mandatory electronic invoicing between companies from 2026. Optimize your invoicing processes now with Flexina and enjoy efficient and effective management.

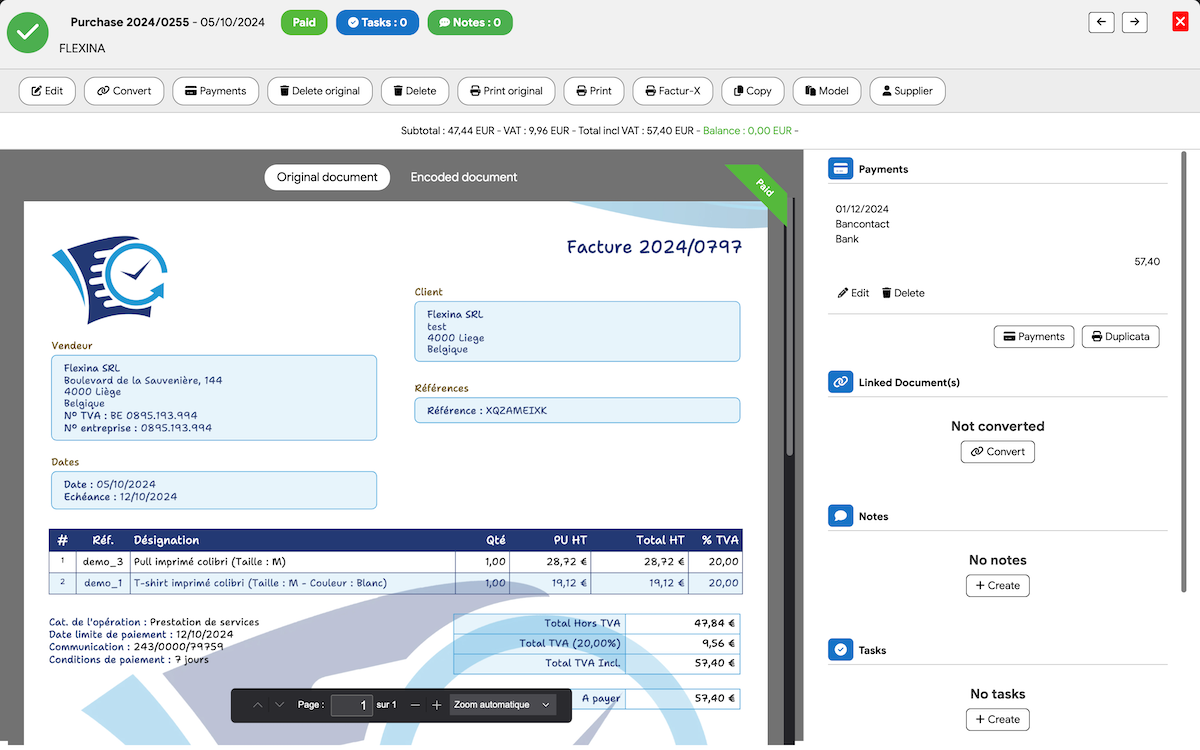

Flexina Invoicing offers you a seamless solution for receiving your electronic invoices via the Peppol network. You can also benefit from immediate receipt of your e-invoices with our invoicing software.

For those using our purchase management module, your Peppol e-invoices are automatically encoded in our software, ready for your accounting. For others, digital invoices are delivered to you by email.

Flexina stands out as the undisputed choice for electronic invoicing, simplifying every step. Our commitment is to handle all the complexity for our users, making Flexina Invoicing the best software for efficient and smooth management of your electronic invoices.

Electronic invoicing is becoming a mandatory requirement in Belgium, both for transactions with public administrations (B2G) and soon for exchanges between private companies (B2B). The Peppol network is emerging as the standard solution to ensure secure, fast, and compliant transactions under European regulations.

With Flexina, discover everything you need to know about electronic invoicing in Belgium: legal obligations, the benefits of the Peppol network, accepted invoice formats, and how to ensure compliance before 2026.

Our experts answer all your questions to guide you through this transition to a modern and automated invoicing system.