What is an intra-Community VAT number?

The intra-Community VAT number is a unique number that identifies each VAT-liable company domiciled in one of the European Union countries.

How is an intra-Community VAT number composed?

Each European Union country has its own structure but starts with two letters identifying the country.

For example:

In Belgium: intra-Community VAT numbers are composed of the first two letters of the country: BE followed by 0 and the nine digits corresponding to the company number.

Example BE0895193994

In France: intra-Community VAT numbers start with FR and are followed by 11 digits (two control digits + company SIREN number).

Example: FR11123456789

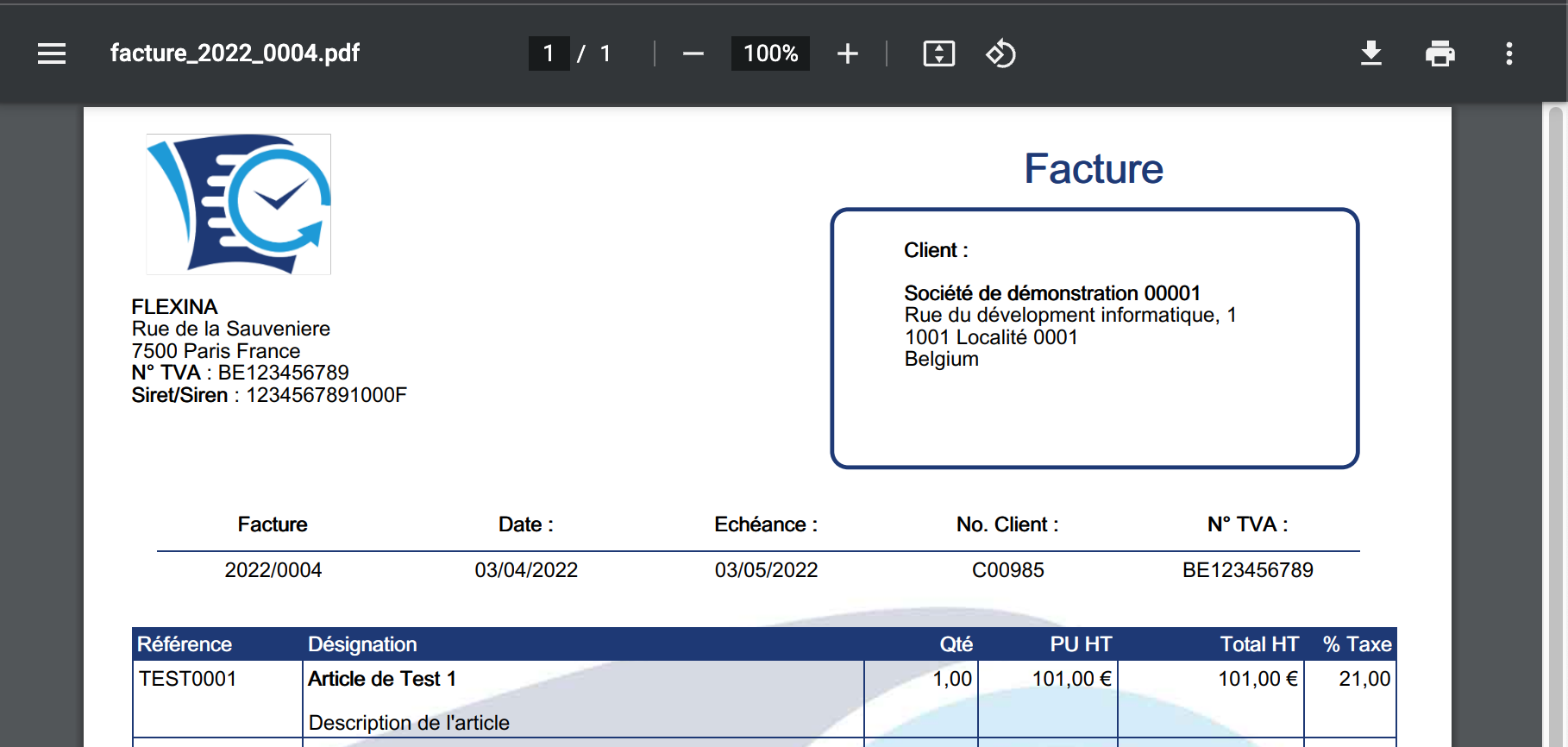

Should the intra-Community VAT number be displayed on invoices?

VAT numbers are part of the mandatory information on invoices.

If the seller and buyer are VAT-liable companies, the seller must display their intra-Community VAT number on the sales invoice as well as the buyer's intra-Community VAT number.

If the seller is VAT-liable but the buyer is not, the seller must still display their intra-Community VAT number on the invoice.

How can I verify an intra-Community VAT number?

To verify a VAT number, the European Commission has set up an Internet service (VIES) that allows querying the databases of member states.

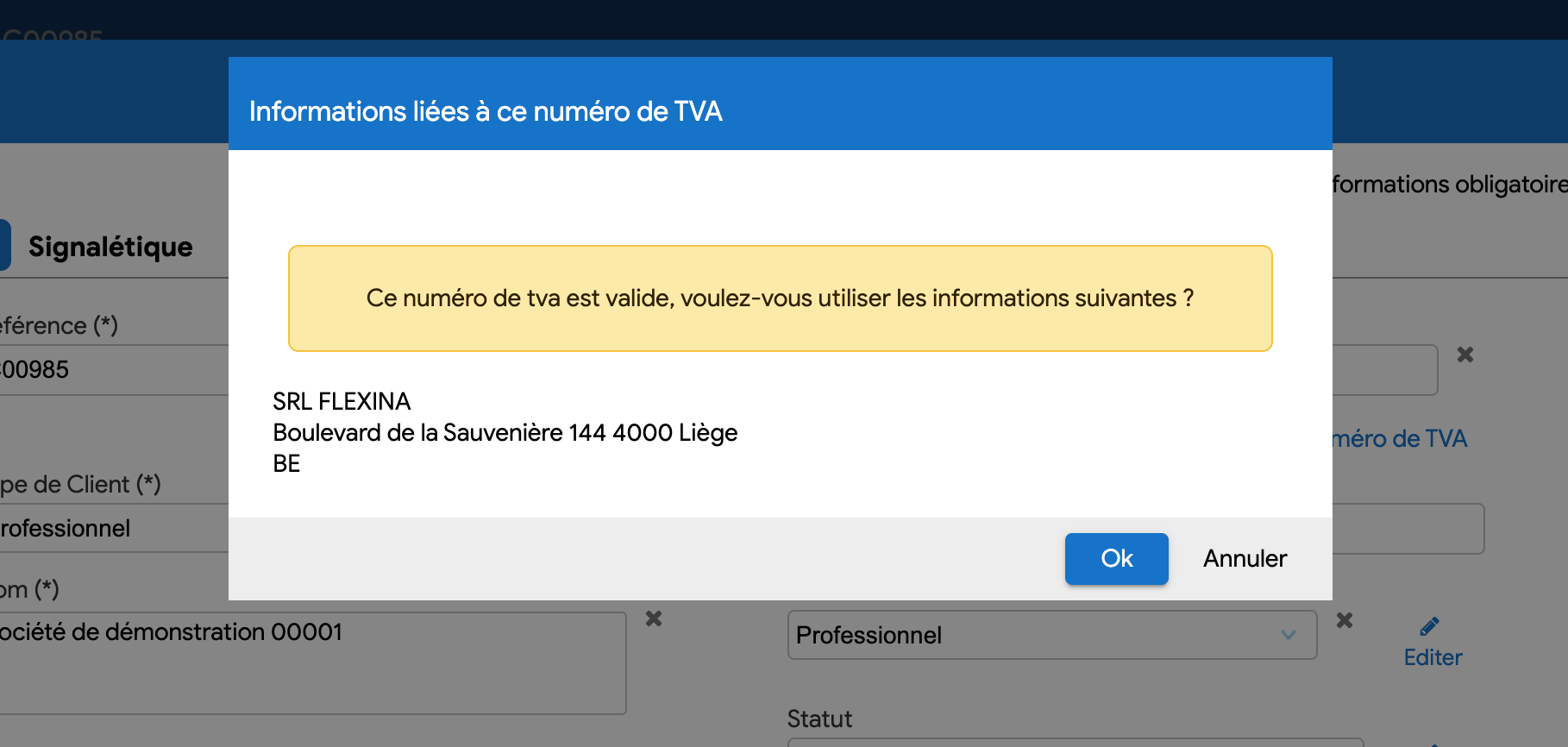

For many intra-Community numbers: the VIES site allows, in addition to number verification, obtaining the name and address of the VAT-liable company to which the verified VAT number corresponds.

Flexina invoicing software uses the European Commission's VIES web service and allows, when entering a client, to verify their VAT number and capture the company name and address when this information is available.

What to do if the client's intra-Community VAT number is incorrect or the VIES site cannot verify it or the site only indicates the number's validity without identifying the verified company?

The intra-Community VAT number of a VAT-liable client is mandatory on invoices and essential when invoicing with the intra-Community VAT rate (0%) when the client is a company from another member state.

For security, when you have doubts about the validity of an intra-Community VAT number: it is preferable to contact your tax administration to verify the validity of this number.

Take advantage of a free trial of our invoicing software that will allow you to verify your clients' VAT numbers and/or get a free online demonstration with one of our team members.